Stop Wasting Time on Finances: Save 10+ Hours Monthly

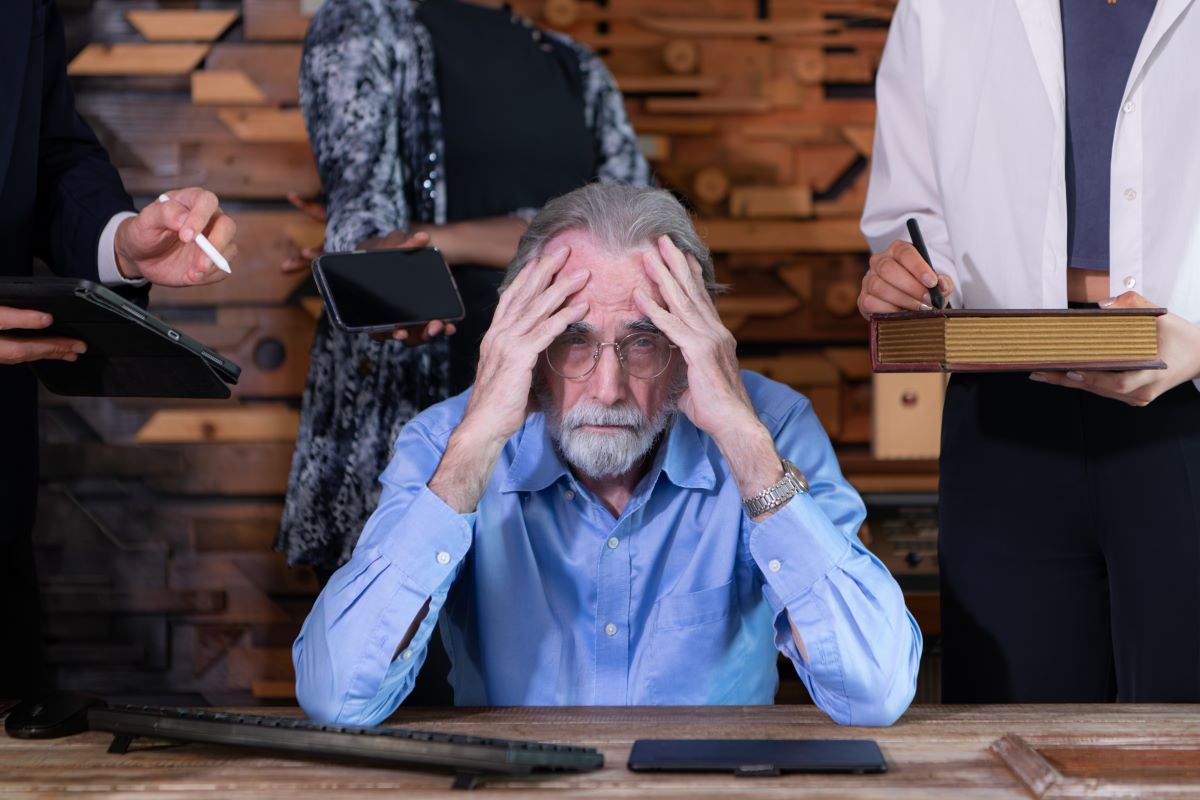

How Small Business Owners Waste 10+ Hours a Month on Finances (And How to Stop)

You didn’t start your business to spend your nights categorizing transactions.

But here you are sifting through receipts, double-checking invoices, and praying your QuickBooks file makes sense before tax season.

Sound familiar?

If you’re like most small business owners, you're wasting 10 to 15 hours every single month on financial admin. That’s a week and a half each year spent on work that doesn’t grow your business, and in many cases, could be done faster, smarter, or not by you at all.

The truth is:

Most of the time spent on business finances is unnecessary.

The biggest time-wasters are hiding in plain sight; you just don’t realize it yet.

And the longer you keep “just getting through it,” the more it costs you in missed opportunities, stress, and sometimes, costly mistakes.

In this guide, we’re going to walk through:

The most common ways small business owners waste time on their finances (and don’t even realize it)

How to identify exactly where your time is going each month

What to do instead, including automation, delegation, and smart outsourcing

How to reclaim 10+ hours a month with clarity, confidence, and zero chaos

Let’s get into it.

Are You Wasting Time on Your Finances? (The Real Cost)

You probably feel like you’re only spending a few hours a month on your books.

But when you actually stop to track it, the number is higher than you think.

Here’s what usually eats up time:

Logging expenses manually

Processing payroll

Creating and sending invoices

Following up on late payments

Digging through receipts at tax time

Trying to fix QuickBooks mistakes

Even if each task only takes “a little while,” the total adds up.

Many small business owners lose 10–15 hours every month on financial admin.

That’s nearly two full working days every month doing things that don’t grow your business.

Why It’s More Than “Just Time.”

It’s not just the hours.

When you’re stuck in the weeds of numbers and deadlines, you lose:

Focus

Energy

Creative momentum

Opportunities to serve your clients

Time for actual business growth

And let’s be real:

Financial tasks are mentally exhausting, especially when you’re not confident you’re doing them right.

So it’s not just “busywork.”

It’s a costly distraction that slows your business down.

7 Time-Wasting Mistakes Small Business Owners Make with Their Finances

You’re not intentionally wasting time. But certain habits, often small ones, stack up fast. These seven mistakes are some of the biggest reasons small business owners lose 10+ hours a month.

1. Mixing Business and Personal Finances

Blending business and personal transactions might feel harmless in the moment. One charge here, one shared account there. But when it’s time to organize your records, it becomes a sorting nightmare. You’ll spend hours just figuring out what belonged where, and possibly miss deductions in the process.

2. DIY Bookkeeping (Without the Right Training)

Bookkeeping software has made it easy to feel like you’re doing things right. But guesswork adds up. Misclassifications, missed entries, or inconsistencies usually mean wasted time fixing errors or worse, facing issues come tax time.

The IRS Self-Employed Tax Center explains the reporting requirements and estimated tax rules every small business owner needs to follow, many of which are missed with DIY bookkeeping.

3. Manual Payroll Processing

Handling payroll manually isn’t just about writing checks. It’s tracking hours, filing reports, calculating taxes, and hitting strict deadlines. Each round of payroll steals time and attention, and even one mistake could trigger compliance issues.

According to the IRS guide on employment taxes, employers are responsible for accurate payroll tax withholding, filing, and reporting, a task many small business owners underestimate.

4. Avoiding Monthly Reconciliations

If you don’t reconcile your books regularly, issues pile up quietly. By the time you catch a missing transaction or double entry, you’ve already spent twice as long trying to untangle the mess. It’s one of the most overlooked time drains.

5. Underusing Accounting Tools

QuickBooks and similar tools are great if you know how to use them. Many business owners leave powerful features untapped or skip the setup process entirely. That means doing things manually that software could’ve handled for you automatically.

Accounting tools are designed to record what already happened, not to manage the operational steps that prevent financial problems in the first place. Without a system connecting tasks, communication, and visibility, even good software becomes underused. Integrated operating systems like Kyrios exist to address this gap by reducing the hidden work that creates financial inefficiencies.

6. Waiting Until Tax Season to Get Organized

Scrambling during tax season is common, but costly. Digging up receipts, chasing reports, and trying to remember what happened ten months ago takes way more time than doing a little prep throughout the year. It’s not just inefficient, it’s stressful.

7. Trying to Do Everything Yourself

This is the most common trap of all. You may not trust anyone else to do it right. Or maybe you feel like you’re saving money. But in reality, doing everything yourself costs you the one thing you can’t get back: time.

Why Small Business Owners Struggle to Let Go (Even When It’s Costing Them)

Let’s be honest, it’s not just about time.

It’s about trust.

Most small business owners know they’re spending too many hours on finances. But letting go of control? That’s a whole different story.

You’ve Been Burned Before

Maybe you hired someone in the past who made mistakes.

Maybe a tax pro missed deductions or didn’t return your calls.

Now, you hesitate. And the thought of putting your books in someone else’s hands? It makes your stomach turn.

That hesitation is understandable. But holding onto everything “just in case” is slowly draining your time and your energy.

You’re Worried You’ll Lose Control

Here’s a fear many business owners carry:

“If I outsource this, I won’t know what’s going on with my money.”

But the right support doesn’t take away control. It gives you clarity.

It gives you back your time and your visibility with better systems, better insights, and fewer last-minute scrambles.

You Think It’s Not “Bad Enough” Yet

Sometimes it doesn’t feel urgent. You’re surviving. Getting by.

So you keep pushing it off.

But survival mode is expensive. Every month you spend “just getting through” your finances is another month you’re pulled away from the work that actually grows your business.

Letting go isn’t easy. But neither is staying stuck.

How to Reclaim 10+ Hours a Month (Without Losing Control of Your Business)

You don’t need to overhaul your entire business to save time.

In most cases, it starts with a few small decisions and a little bit of structure.

Here’s how you can reclaim hours each month and still feel totally in control of your finances.

1. Automate the Low-Hanging Fruit

If you’re still entering data by hand or sending every invoice manually, you’re doing too much.

Start with automation that works quietly in the background:

Use accounting software like QuickBooks or Xero to auto-sync transactions

Set up recurring invoices and automated payment reminders

Use payroll systems (like Gusto) to handle paydays, filings, and direct deposits

These aren’t just tech hacks; they’re time-freeing tools.

2. Set a Weekly Financial Routine

Trying to “get around to it” doesn’t work.

A 30-minute check-in each week can save you from hours of scrambling later.

Pick one day a week to:

Review income and expenses

Reconcile bank transactions

Flag any unusual charges

Upload receipts before they disappear forever

You don’t need a degree in accounting, just consistency.

3. Delegate What You Don’t Need to Touch

This is the tipping point for many business owners.

Ask yourself:

Am I the only person who can do this task?

Is this work generating revenue or just keeping me busy?

Could someone else do this faster, better, or with less mental strain?

Chances are, the answer is yes.

Delegating doesn’t mean you’re stepping back.

It means you’re stepping up into the role you’re actually meant to play.

4. Outsource with Support (Not Confusion)

Outsourcing doesn’t have to feel like giving up control.

The key is transparency and trust.

When done right, outsourcing:

Gives you better reports and real insights

Keeps your finances compliant and audit-ready

Removes the weight of deadlines and guessing games

It doesn’t mean you disappear; it means you stop wasting time.

What to Expect When You Outsource Your Bookkeeping (It’s Not as Scary as You Think)

The idea of handing over your financials can feel intimidating. We get it.

But good bookkeeping support shouldn’t feel like a black hole; it should feel like relief.

Here’s what outsourcing actually looks like when it’s done right.

It Starts with a Conversation

No pressure. No sales pitch.

Just a real talk about where you’re spending time and where things feel messy.

You’ll walk through:

What systems are you currently using (or not using)

Where is the most time being lost

What you need help with and what you want to keep doing yourself

The goal? Clarity. Not confusion.

You Stay in the Loop Without Doing the Work

The right bookkeeping partner doesn’t just take over; they check in, send reports, and keep you informed.

You still:

Review your financials

Approve decisions

Make the calls that matter

But you’re not chasing receipts or watching tutorials on how to fix a bank feed error.

You Get Back Time and Peace of Mind

When someone else is managing your books correctly:

You stop second-guessing your numbers

You have clean records for tax season

You know where your money is going (and what to do about it)

And maybe most importantly, you breathe a little easier.

You Don’t Need to Be “Big” to Get Help

You don’t need a team of 20 to need support.

If your business is making money, your time is valuable, and your finances deserve structure.

Outsourcing isn’t about being “ready.” It’s about realizing that doing it all yourself is slowing you down.

Final Thoughts: Your Time Is Better Spent Growing, Not Chasing Receipts

You didn’t build your business to spend your weekends sorting receipts and double-checking payroll reports.

But if you're still trying to manage it all yourself, the bookkeeping, the taxes, the invoices, you're not just losing time. You're losing momentum.

And you don’t need to keep doing it that way.

Reclaim Your Time, Reduce Stress, and Get Expert Support Without Losing Control

At Trustway Accounting, we help small business owners take back 10+ hours a month with proactive, personalized financial support.

No jargon. No pressure. Just clear answers and real help.

Let’s find out where you’re losing time, and how to fix it.

👉 Schedule your free 30-minute Time Recovery Call and get expert eyes on your finances.

It’s simple. It’s stress-free. And it might be the most productive 30 minutes you’ll spend all week.