What to Know About the Earned Income Tax Credit

What is the Earned Income Tax Credit?

The Earned Income Tax Credit (EITC) is a refundable tax credit for low to medium-income workers and families. It’s filed along with a tax return (Form 1040 or 1040-SR). The EITC form doesn’t have a number designation like other tax forms. It’s simply called Schedule EIC.

According to the IRS, “If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.” The EITC can only affect you positively. If you owe an amount, this credit can reduce the amount you have to pay, and if you owe nothing, you’ll receive the amount as a refund.

For example, Mary owes $6,000 in taxes, but she qualifies for the EITC. When she files her tax returns, she fills out the EITC form and later discovers that she’s eligible to receive $3,000 from it. This cuts the amount she owes in half, now totaling $3,000 instead of $6,000.

Ralph, on the other hand, owes nothing. This is an accomplishment in itself, and what is recommended to strive for. However, he learned from a friend about the EITC. When he files his tax returns, he fills out the EITC form along with it. It turns out that he’s eligible to receive $5,500.

So, what makes these two different? Why did Mary only get $3,000 while Ralph got $5,500? Well, it depends on a few factors …

Who can receive the Earned Income Tax Credit?

Not everyone …

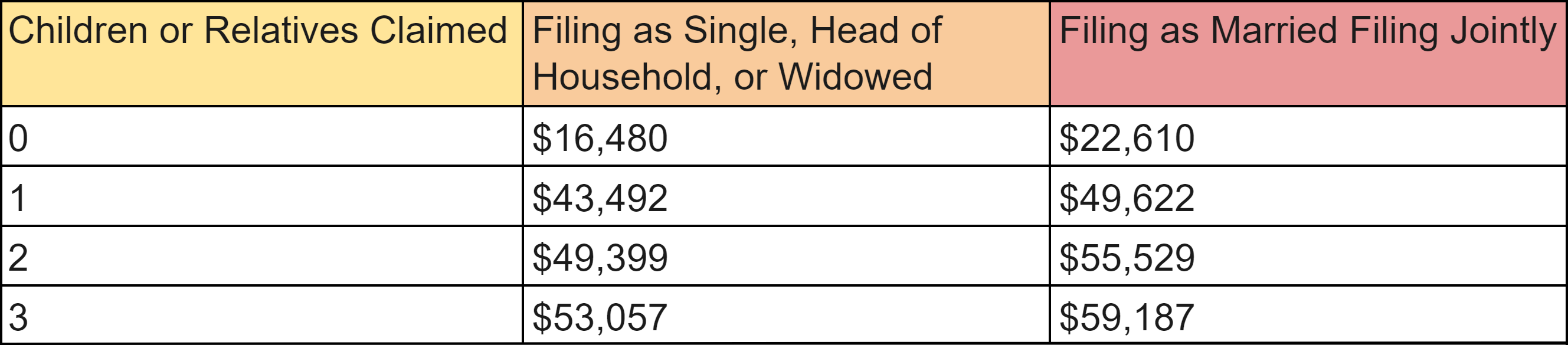

To qualify for the Earned Income Tax Credit as single, head of the household, or widowed, you have to either:

Have no children and make below $16,480

Have one child and make below $43,492

Have two children and make below $49,399

Have three children and make below $53,057

If you’re married and filing jointly, however, you have to either:

Have no children and make below $22,610

Have one child and make below $49,622

Have two children and make below $55,529

Have three children and make below $59,187

This chart from the IRS makes it easier to view this information:

Please note that the amount of money you can receive from the EITC will not scale past three children.

The IRS also lists these additional qualifications:

Investment income must be below $10,300 for the tax year

Must have a valid Social Security number by the due date of the tax return

Must have been a U.S. citizen or resident alien all year

Form 2555 (Foreign Earned Income) must not be filed

Follow rules concerning separation from your spouse and not filing jointly

How much can I get with the Earned Income Tax Credit?

There is a limit to how much money you can receive with the EITC. If you have no qualifying children, you can get up to $560; If you have one qualifying child, you can get up to $3,733; If you have 2 qualifying children, you can get up to $6,164; and if you have 3 or more qualifying children, you can get up to $6,935.

With these numbers, it’s easy to see why Mary and Ralph received completely different amounts. Mary most likely has one child that qualified for the Earned Income Tax Credit, while Ralph most likely has two.

To be a qualifying child for the EITC, the child must be your: Son, daughter, stepchild, adopted child, or foster child; Brother, sister, half-brother, half-sister, stepsister, or stepbrother; Grandchild, niece, or nephew.

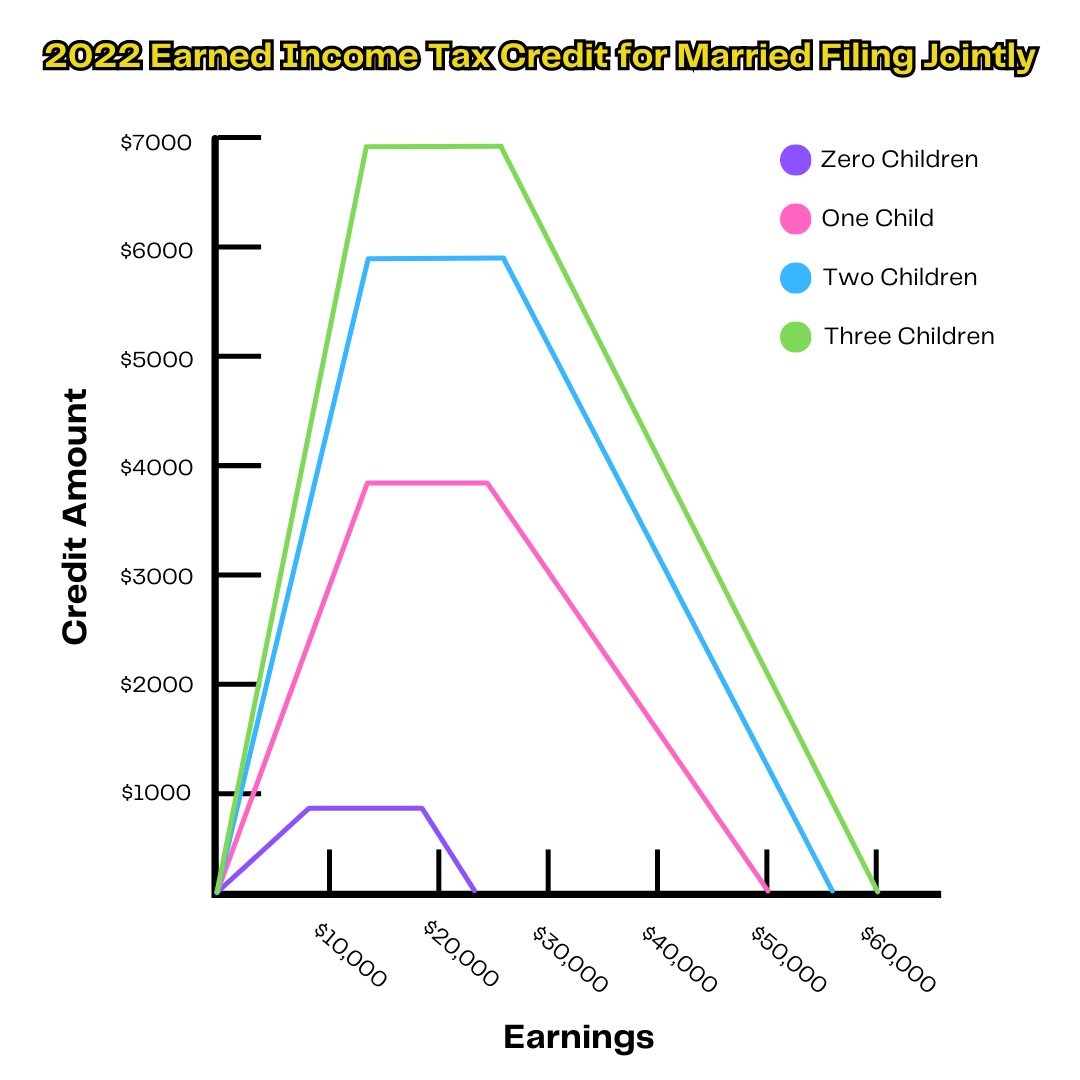

This graph shows estimates of the amounts of money you could receive based on your income and number of qualifying children:

How can I file for the Earned Income Tax Credit?

To claim your Earned Income Tax Credit, you must file Form 1040 (U.S. Individual Income Tax Return) or Form 1040 SR (U.S. Tax Return for Seniors), and if you have one or more children that qualify, you must then file the Schedule EIC (Form 1040 or 1040-SR).

It’s possible that there may be a delay for the EITC if you file for it before mid-February, but expect it to be deposited to your account by March 1st, barring any issues with the tax return that may arise. You can use the IRS2Go mobile app to track your refund.

It’s also worth noting that even if you missed out on the EITC last year, you can still file for it. If you file an amendment (1040-X) you can apply for the EITC for a previous year.

Does my state have an Earned Income Tax Credit?

The EITC is available at a federal and state level, and it’s entirely possible to receive both. If you qualify for the federal EITC, you’ll qualify for the one in your state. Unfortunately, not every state has an Earned Income Tax Credit …

Taxoutreach.org provides a helpful graphic that illustrates which states do and do not have a state EITC, as well as percentages that represent the portion of the federal EITC that each state gives out.

Don’t try this at home …

An incorrectly filed EITC is the most common red flag that triggers auditing. Often, people will try to file for it themselves and they’ll make mistakes. Filling out the EITC incorrectly can result in a fine of $500. To be safe, don’t try to do this yourself.

Trustway Tax & Accounting specializes in tax preparation, accounting, and payroll services. Let us help you with all of your tax and accounting needs. Visit our tax page for more information or get in touch with us at (205) 451-1945.