Take a break

and read all about it!

Gross vs Net Pay: What Business Owners Need to Know About Payroll

Gross vs Net Pay: Understanding Your Payroll

Differences Between Gross and Net Pay

Importance for Small Business Owners

When it comes to managing payroll, understanding the difference between gross pay and net pay—commonly referred to as gross vs net pay—isn’t just a nice-to-know, it’s essential. Whether you're reviewing your own paycheck or running payroll for a growing team, this distinction impacts everything from budgeting and employee satisfaction to compliance and taxes.

Many business owners find themselves asking:

“Why does my employee's paycheck look smaller than the amount I approved?”

or

“How do I calculate take-home pay without making a mistake?”

If these questions sound familiar, you’re not alone—and you’re in the right place.

At Trustway Accounting, we believe payroll shouldn’t be a mystery or a source of stress. In this guide, we’ll break down gross vs net pay in a way that’s clear, relatable, and built specifically for small business owners like you.

What is Gross Pay?

Gross pay is the total earnings an employee receives before any taxes or deductions are taken out. It’s often the number that catches attention on a job offer or employment contract, but it’s not what ends up in the employee’s bank account.

For business owners, understanding gross pay is critical because it's the foundation of your payroll expenses. Get it wrong, and you may run into compliance issues, budgeting problems, or employee dissatisfaction.

What’s Included in Gross Pay?

Gross pay can include more than just a base salary or hourly wage. Depending on the role and compensation package, it may consist of:

Base salary or hourly wages

Overtime pay

Commissions or performance bonuses

Paid time off (sick days, holidays, vacation pay)

Tips (for service roles)

Other taxable benefits (e.g., car allowance, incentive pay)

Example:

Imagine your employee Sarah is a sales associate with a base salary of $45,000/year. In one month, she also earns a $500 bonus for meeting a sales target. Her gross pay for that month would be:

$45,000 ÷ 12 = $3,750

Add bonus: $3,750 + $500 = $4,250 gross pay

How Gross Pay is Calculated

Gross pay varies depending on how the employee is compensated—salaried or hourly.

Salaried Employees: Gross pay is calculated by dividing the annual salary by the number of pay periods (monthly, biweekly, etc.).

Hourly Employees: Gross pay is calculated by multiplying hours worked by the hourly rate, plus any applicable overtime.

Example:

John is an hourly warehouse employee who earns $18/hour. This pay period, he worked 160 regular hours and 10 overtime hours (paid at time-and-a-half).

Regular pay: 160 × $18 = $2,880

Overtime pay: 10 × $27 = $270

Total Gross Pay = $3,150

What is Net Pay?

Net pay, often called take-home pay, is the amount an employee actually receives in their paycheck after all deductions are taken out of their gross pay. It’s what shows up in their bank account on payday—and what most employees care about most.

From a business owner’s perspective, understanding net pay is crucial for managing payroll costs, ensuring compliance with tax laws, and maintaining trust with your team.

What’s Deducted From Gross Pay?

To arrive at net pay, several mandatory and optional deductions are subtracted, including:

Mandatory Deductions

Federal income tax

Social Security and Medicare (FICA taxes)

State income tax (where applicable)

Local taxes (in certain jurisdictions)

Voluntary Deductions

Health insurance premiums

Retirement contributions (like 401(k))

Wage garnishments

Union dues or charitable contributions

Example:

Let’s go back to Sarah, whose gross pay for the month was $4,250. Here are her deductions:

Federal income tax: $550

Social Security & Medicare: $325

State tax: $150

Health insurance: $175

Total deductions: $1,200

Net Pay = $4,250 - $1,200 = $3,050

Why Net Pay Matters

Employees budget around it: Net pay is what they use to cover rent, groceries, and bills.

Misunderstandings can cause tension: If gross pay and net pay aren’t clearly communicated, employees might feel shortchanged—even when everything is calculated correctly.

Business planning depends on it: Understanding net pay helps you estimate your actual payroll burden (which includes employer-paid taxes and benefits too).

Pro Tip from Trustway Accounting

Business owners often overlook the employer-side costs that don’t appear in net pay—like your portion of payroll taxes, unemployment insurance, and benefits contributions. At Trustway Accounting, we help you understand the full picture so your budgeting is airtight and compliant.

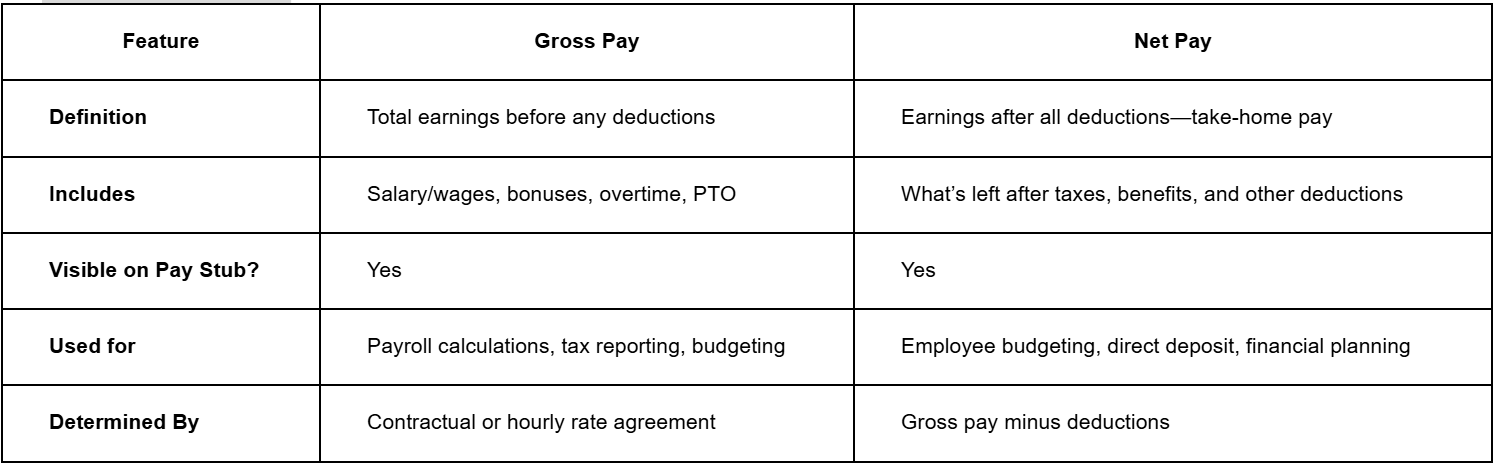

Differences Between Gross and Net Pay

While gross pay and net pay are closely connected, they serve very different purposes in payroll and financial planning. As a business owner, it's essential to understand how these two figures relate—and why both matter.

Side-by-Side Comparison

Example Breakdown: Monthly Paycheck

Let’s walk through a realistic payroll scenario to show both gross and net pay in action.

Example:

Mia is a salaried graphic designer earning $54,000/year, paid monthly. This month, she also earned a $1,000 bonus for completing a major project.

Gross Pay: $54,000 ÷ 12 = $4,500

Add bonus = $4,500 + $1,000 = $5,500 Gross Pay

Deductions:

Federal tax: $650

State tax: $250

Social Security & Medicare: $420

Health insurance: $180

Total deductions: $1,500

Net Pay = $5,500 - $1,500 = $4,000

Why This Difference Matters

For employees, understanding gross vs net pay helps with realistic budgeting. For employers, it impacts how you:

Set compensation packages

Forecast total payroll expenses

Ensure accurate withholdings for compliance

It also plays a role in managing employee expectations. Clear pay communication reduces confusion and builds trust—especially when employees see a lower number on their direct deposit than they expected.

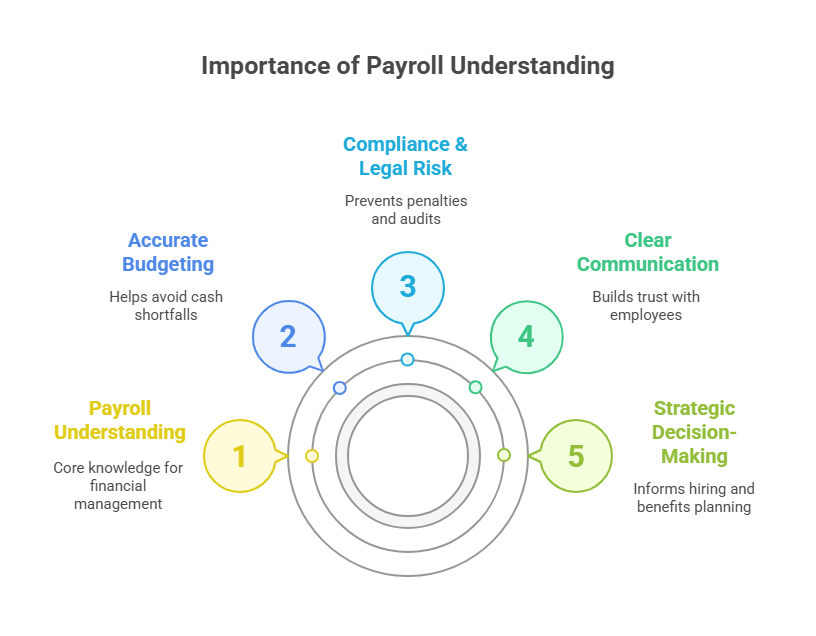

Importance for Small Business Owners

If you run a small business, understanding the difference between gross and net pay isn’t just helpful—it’s vital. Payroll is often one of your biggest monthly expenses, and even small errors can lead to compliance issues, strained employee relationships, or financial surprises.

Let’s explore why this knowledge matters to your business operations, planning, and peace of mind.

1. Accurate Budgeting & Cash Flow Planning

Gross pay gives you a starting point for your total payroll liability, but it’s not the whole picture. In addition to the employee’s gross pay, you’ll also be responsible for:

Employer-paid taxes (like Social Security, Medicare, and unemployment insurance)

Contributions to benefits (e.g., health plans, retirement plans)

Payroll processing fees (if outsourced)

Example:

You agree to pay an employee $4,000/month in gross wages. But your true payroll cost might be closer to $4,600 once you include payroll taxes and benefits.

Knowing this difference helps you avoid cash shortfalls at payroll time.

2. Compliance & Legal Risk

If you don’t properly calculate deductions from gross pay—or you misclassify employees as contractors—you could face:

IRS penalties

State tax audits

Fines for wage and hour violations

Trustway Tip: We’ve helped clients uncover costly errors from past payroll cycles. Avoiding mistakes today protects your business tomorrow.

3. Clear Communication with Employees

Misunderstandings around pay are a leading cause of employee dissatisfaction. When gross and net pay aren't clearly explained, employees might assume they're being shortchanged.

Example:

Your employee sees they were offered $55,000/year, but their monthly deposit is closer to $3,200. Explaining how taxes and benefits affect take-home pay shows transparency and builds trust.

4. Strategic Decision-Making

Whether you're planning to give raises, hire new staff, or offer benefits, knowing how gross vs net pay impacts both your budget and employee morale will help you make smarter choices.

At Trustway Accounting, we guide small business owners through these decisions with clarity, strategy, and proactive insight—not just spreadsheets.

Common Mistakes and How to Avoid Them

Even well-meaning business owners can make payroll mistakes that create unnecessary stress, legal issues, or financial penalties. Fortunately, most of these missteps are avoidable—especially when you understand the difference between gross pay and net pay, and how each fits into your overall payroll process.

Let’s look at some of the most frequent errors—and how to prevent them.

1. Misclassifying Workers

Some businesses incorrectly label employees as independent contractors to simplify payroll or reduce costs. However, this misclassification can lead to serious legal trouble, especially if you're deducting taxes or failing to offer benefits where required.

Example:

You hire a part-time assistant and treat them as a 1099 contractor, but you set their schedule and provide all their tools. According to the IRS, they likely qualify as a W-2 employee. If audited, you may owe back taxes, penalties, and interest.

How to Avoid It:

Review IRS classification rules, and when in doubt, get a professional assessment. Trustway Accounting helps businesses accurately classify their team and stay compliant.

2. Incorrect Deduction Calculations

Incorrectly calculating deductions like Social Security, Medicare, or state taxes can result in:

Underpayment to tax agencies

Penalties and fines

Frustrated employees whose net pay is off

Example:

You accidentally deduct only 4% for Social Security instead of the required 6.2%. Over time, that discrepancy can grow into a significant payroll tax liability.

How to Avoid It:

Use reputable payroll software or outsource to a firm like Trustway Accounting that ensures all calculations are accurate and compliant with the latest tax rules.

3. Failing to Update Withholding Information

Employees’ tax situations can change due to marriage, children, or other life events. If you don’t encourage regular updates to their W-4 forms, their net pay may be inaccurate, and they could face a big tax bill later.

Example:

Your employee gets married and qualifies for different tax brackets, but never updates their W-4. As a result, they’re under-withheld and shocked by a large tax payment come April.

How to Avoid It:

Remind employees at least once a year to review and update their tax withholding forms, especially after life changes.

4. Not Staying Up to Date on Payroll Laws

Payroll regulations—including minimum wage, overtime rules, and deduction limits—change regularly. Failing to stay informed could leave your business exposed.

How to Avoid It:

Partner with a proactive accounting firm (👋 like us!) that stays ahead of the law and notifies you of changes before they become a problem.

How Trustway Accounting Can Help

Managing payroll isn’t just about cutting checks—it’s about protecting your business, supporting your team, and staying confidently compliant. If calculating gross and net pay is causing stress or uncertainty, you don’t have to go it alone.

At Trustway Accounting, we offer more than just number-crunching—we provide peace of mind and personalized support every step of the way.

Full-Service Payroll Management

From gross pay calculations to final net pay distributions, we handle everything with accuracy and care:

Setup and management of payroll schedules

Tax withholding and employer contributions

Direct deposit and secure payment processing

Filing of payroll tax forms (e.g., 941s, W-2s, 1099s)

Year-end reports for tax prep and compliance

Example:

A small construction firm came to us frustrated by payroll errors and late filings from their previous provider. We revamped their payroll system, ensured proper worker classification, and got them back in compliance—saving over $6,000 in penalties and lost productivity.

Real-Time Reporting & Clarity

With Trustway’s payroll services, you don’t just get reports—you get insight. We provide:

Regular breakdowns of gross vs net pay

Transparent tracking of employer costs

Clear reports to help you budget and grow with confidence

Personalized Guidance for Small Business Owners

Whether you’re hiring your first employee or scaling your team, we tailor payroll solutions to your unique needs. No jargon. No guesswork. Just proactive advice and expert support.

“Trustway Accounting completely simplified our payroll process. I no longer worry about missing deadlines or making mistakes. They’re truly part of our team.” — Client Testimonial

Ready to Make Payroll Stress-Free?

Let us do the heavy lifting. With year-round availability, responsive service, and a deep understanding of what small businesses need, we’re here to help you streamline payroll and focus on growth.

Conclusion: Why Gross vs Net Pay Really Matters

Payroll can feel overwhelming—but it doesn’t have to be.

By understanding the difference between gross pay and net pay, you’re not just crunching numbers. You’re taking control of your business finances, avoiding compliance issues, and building stronger relationships with your team.

Whether you’re reviewing paychecks, setting salaries, or planning for growth, knowing how each dollar is calculated helps you make smarter, more confident decisions.

And remember—you don’t have to figure it all out alone.

Let Trustway Accounting Help You Simplify Payroll

At Trustway Accounting, we specialize in taking the stress out of payroll. Our expert team helps business owners:

Understand every line of their payroll reports

Ensure accurate withholdings and deductions

Avoid costly errors and last-minute tax headaches

Get proactive support all year long—not just during tax season

Ready to make payroll one less thing to worry about?

Contact us today to schedule a consultation and see how we can help you streamline your payroll and support your business growth—with clarity, compliance, and confidence.

Are You Ready To Free Yourself Financially?

Drop Us A Line And Keep In Touch