Take a break

and read all about it!

Stress-Free Paydays: Boost Team Growth with Easy Payroll

As your business grows, so does your team. This expansion brings excitement and opportunities but also introduces new challenges, particularly when it comes to payroll. Managing increasing numbers of employees, complying with ever-changing tax regulations, and ensuring timely and accurate payments can quickly become overwhelming. This is where professional payroll services become invaluable.

What is a Payroll Service?

A payroll service is a company that handles the administrative tasks related to paying employees and managing payroll-related functions for other businesses. This includes calculating wages, withholding taxes, processing direct deposits, and ensuring compliance with employment laws and tax regulations. Payroll services are designed to streamline the payroll process, reduce administrative burdens, and minimize errors by leveraging expert knowledge and technology.

Why Payroll Services Matter for Growing Businesses

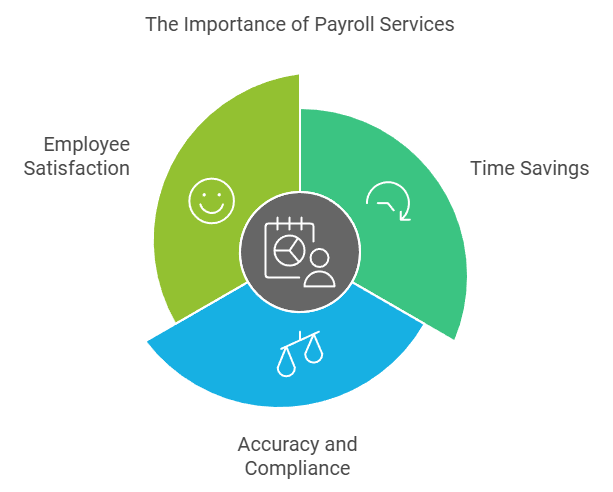

Outsourcing your payroll to a dedicated service offers several advantages:

Time Savings: Payroll processing is time-consuming and requires attention to detail. By outsourcing this task, you free up valuable time for business owners to focus on core operations and strategic growth.

Accuracy and Compliance: Payroll involves intricate calculations and adherence to federal, state, and local tax laws. Payroll service providers are experts in these areas, ensuring accurate calculations, timely deposits, and compliance with all regulations. This helps you avoid costly penalties and errors.

Employee Satisfaction: Timely and accurate payroll is essential for employee satisfaction and morale. By ensuring employees are paid correctly and on time, you foster a positive work environment and reduce the risk of turnover.

Understanding Payroll Service Costs

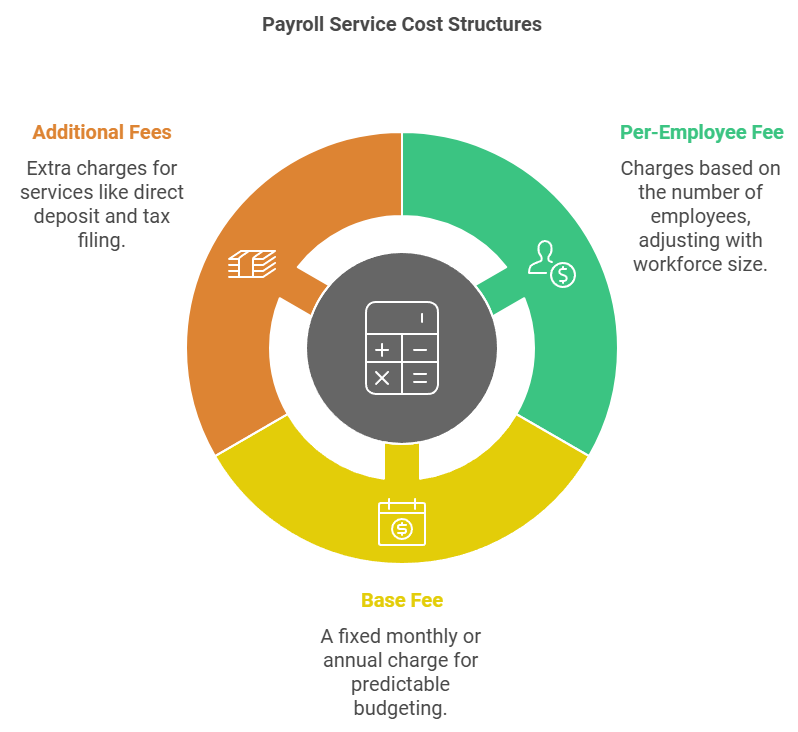

The cost of payroll services can vary widely based on several factors, including the size of your business, the number of employees, and the specific features you need. Here’s a detailed look at how payroll service pricing typically works:

Per-Employee Fee:

Monthly or Per-Payroll Charges: Many payroll service providers charge based on the number of employees. This fee can be applied either on a per-month basis or per payroll run. For example, if you have 20 employees and the provider charges $10 per employee per month, you would pay $200 each month.

Scaling Costs: As your workforce grows, the cost will increase proportionally. This model is advantageous for businesses with fluctuating staff levels as it adjusts with the number of employees.

Base Fee:

Flat Monthly or Annual Charges: Some payroll services have a flat fee structure, where you pay a fixed amount each month or year regardless of the number of employees. This can be beneficial for budgeting as it provides predictable costs.

Service Inclusions: This base fee often covers basic payroll processing and may include a set number of payroll runs or standard features. Additional costs might apply for extra services or higher levels of support.

Additional Fees:

Direct Deposit Fees: If you opt for direct deposit services, there may be an extra charge for this convenience. Some providers include this in their base fee, while others may charge per transaction.

Tax Filing Fees: Fees may apply for handling and filing payroll taxes. This could include federal, state, and local tax filings, as well as the preparation of necessary tax forms.

401(k) Administration: If your company offers a 401(k) plan, additional fees may be charged for managing and administering these retirement contributions and ensuring compliance with regulations.

Custom Reports and Support: Specialized reports or additional support beyond the standard service may also incur extra charges. Customization options can vary in cost based on complexity and service provider.

It's important to compare pricing structures from different providers and evaluate the services included in each package. Consider your business's specific needs and budget when choosing a payroll service.

Maximizing the Benefits of Payroll Services

To fully utilize the advantages of your payroll service, consider providers that offer the following features:

Accurate and Timely Payroll Processing:

Precision in Payments: Ensure that each employee is paid the correct amount according to their hours worked, salary, or commission. This includes calculating deductions for taxes, benefits, and other withholdings accurately.

Punctual Payments: Guarantee that payroll is processed and payments are made on time, avoiding delays that could affect employee satisfaction and financial planning.

Tax Compliance:

Up-to-Date Tax Regulations: Stay informed about the latest federal, state, and local tax laws and regulations, which frequently change. This helps in maintaining compliance and avoiding costly penalties.

Automatic Tax Filing: Utilize services that handle the submission of tax forms and payments to tax authorities, ensuring timely and accurate filings.

Employee Self-Service:

Online Access: Provide employees with a secure online portal where they can view and download their pay stubs, tax forms (like W-2s), and other important payroll documents.

Self-Management: Allow employees to update their personal information, such as address or banking details, directly through the portal, reducing administrative workload and errors.

Reporting and Analytics:

Detailed Payroll Reports: Generate comprehensive reports that detail payroll expenses, including breakdowns by department, employee, or time period. This helps in budgeting and financial planning.

Tax Reports and Insights: Access reports that summarize tax liabilities and contributions, assisting in accurate tax planning and compliance.

Employee Data Analytics: Analyze data related to employee hours, overtime, and absences to gain insights into workforce trends and make informed decisions.

Customer Support:

Responsive Assistance: Ensure that the payroll service provider offers prompt and effective customer support to address any issues or queries related to payroll processing.

Expert Guidance: Benefit from knowledgeable support staff who can provide advice on complex payroll issues, tax compliance, and system troubleshooting.

By choosing the right payroll service, you can streamline your operations, reduce errors, and ensure your employees are happy and paid accurately. This allows you to focus on growing your business with confidence.

Outsourcing Payroll: A Smart Choice for Growing Your Business

Managing payroll is one of the most vital yet intricate tasks a business must handle. It involves accurate calculations, regulatory compliance, and meeting strict deadlines—all of which can become increasingly challenging as your company grows. Outsourcing payroll to a professional provider can offer a strategic advantage by streamlining operations and freeing up valuable time and resources.

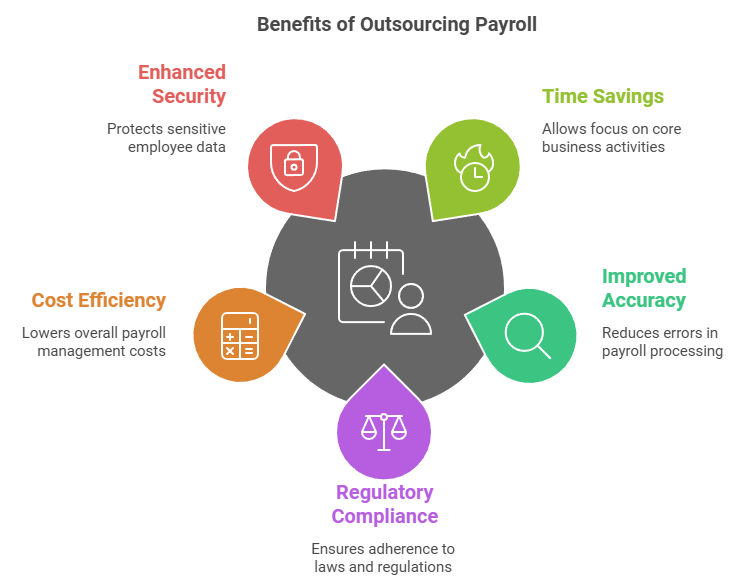

Key Benefits of Outsourcing Payroll

Time Savings

Payroll management requires attention to detail and consistent effort. By outsourcing, businesses can redirect their focus to core operations, such as strategy, customer engagement, and product development. This is especially beneficial for small and medium-sized enterprises (SMEs) that may lack dedicated HR or accounting teams.Improved Accuracy

Payroll errors can lead to dissatisfied employees and potential legal complications. Professional payroll providers have the expertise and systems to ensure precision, reducing the likelihood of mistakes in wage calculations, deductions, and tax filings.Regulatory Compliance

Tax laws and labor regulations are constantly evolving, making compliance a moving target for business owners. Payroll providers stay up-to-date with these changes, helping to safeguard your business against penalties and audits.Cost Efficiency

While there is an upfront cost to outsourcing, it often proves cost-effective in the long run. Outsourcing eliminates the need for in-house payroll software, reduces administrative costs, and minimizes the financial risks associated with errors and non-compliance.Enhanced Security

Payroll involves handling sensitive employee data, including personal and financial information. Outsourcing to a reputable provider ensures robust data protection measures are in place, mitigating the risk of breaches or fraud.

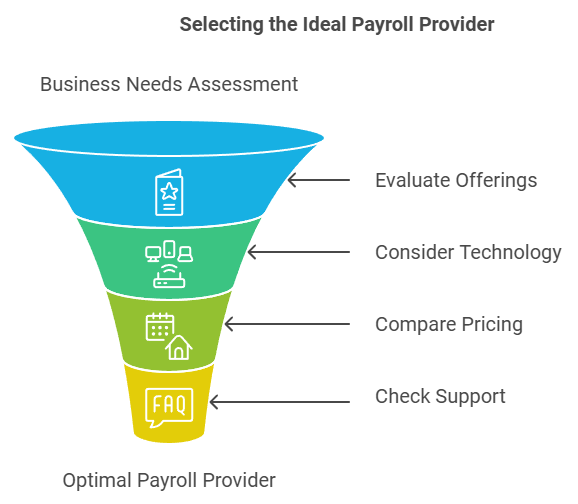

How to Choose the Right Payroll Provider

Assess Your Business Needs

Start by identifying your specific requirements, such as the size of your workforce, the frequency of payroll processing, and any unique needs like international payroll or industry-specific regulations.Evaluate Providers’ Offerings

Look for providers with a proven track record, strong client reviews, and a full suite of services, including tax filing, benefits administration, and time-tracking integration.Consider Technology and Integration

Choose a provider that offers user-friendly platforms, mobile accessibility, and seamless integration with your existing HR and accounting systems.Compare Pricing Models

Understand the provider’s pricing structure and ensure it aligns with your budget. Look out for any hidden fees or additional costs for specific services.Check Customer Support

Reliable customer service is crucial. Opt for a provider with accessible support channels, quick response times, and expertise in handling queries.

We understand the challenges of managing payroll. We offer comprehensive payroll services tailored to businesses of all sizes. Our expertise and dedication to accuracy ensure your employees are paid correctly and on time, allowing you to focus on what you do best – running your business. Contact us today at (205) 463-5260 to learn how our payroll services can benefit your growing team!

Are You Ready To Free Yourself Financially?

Drop Us A Line And Keep In Touch